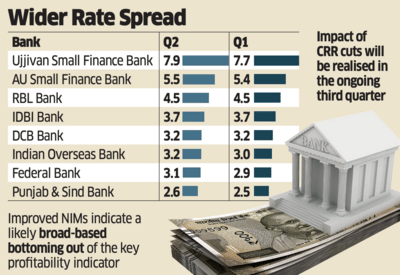

Eight of the 24 banks that have announced second-quarter earnings till Monday reported sequentially improved net interest margins (NIMs), indicating a likely broad-based bottoming out of the key profitability indicator.

A phased reduction in the cash reserve ratio that started in September will further boost their earnings and the margin, top bank executives said.

Among the pack, Indian Overseas Bank posted the highest jump, with the state-run lender’s NIM rising 21 basis points quarter-on-quarter to 3.21%. A business process re-engineering initiative, targeted to raise the share of loans linked to the marginal cost of funds-based lending rate (MCLR), helped the bank improve its margin. Most banks, meanwhile, reported a lower cost of deposits in the past quarter.

The ongoing re-pricing of deposits would, however, be offset by the re-pricing of MCLR-linked loans, which comes at a lag, bank executives said.

Higher MCLR-linked Loans

Private sector DCB Bank, Federal Bank, IDBI Bank, RBL Bank, and state-owned Punjab & Sind Bank are among the universal lenders that posted improved NIMs, a measure of profitability for banks from their lending activities. Among small finance banks, AU and Ujjivan reported higher margin prints in the second quarter.

Federal Bank’s NIM improved by 12 basis points to 3.06%, the fastest rise in the private sector category.

ICICI Bank executive director Sandeep Batra expects his bank’s NIM to remain range-bound with some benefits accruing from the cash reserve ratio (CRR) cuts, with re-pricing of deposits reducing costs. ICICI’s NIM for the second quarter came in at 4.30% against 4.34% in the preceding three-month period.

The CRR is being cut by 100 basis points, or a percentage point, in four equal instalments on September 6, October 4, November 1, and November 29. As a result, the impact of the final three phases will be realised in the ongoing third quarter.

The Chennai-based IOB, with a gross loan portfolio of ₹2.78 lakh crore, has brought down the share of loans linked to the RBI’s repo rate to about 46% at the end of September from about 55% in March, managing director Ajay Kumar Srivastava told ET. This strategic shift taken earlier in the year helped the bank improve its NIM, he said.

The share of the bank’s MCLR-linked loans, which react more slowly to policy rate changes, rose to 49% from about 45% over the last six months, he said.

IOB started implementing this plan at the beginning of the year. “This business re-engineering has yielded results,” Srivastava said.

ET on February 7 reported that some banks were trying to increase the share of MCLR-linked loans, anticipating repo rate cuts. Transmission of policy rate cuts happens automatically to loans linked to external benchmarks like repo. MCLR-linked loans are reset typically twice a year, thereby resulting in a slower transmission.

IOB’s NIM for the quarter was 3.21%, compared with 3.04% for the preceding quarter and 3.08% a year earlier.

A phased reduction in the cash reserve ratio that started in September will further boost their earnings and the margin, top bank executives said.

Among the pack, Indian Overseas Bank posted the highest jump, with the state-run lender’s NIM rising 21 basis points quarter-on-quarter to 3.21%. A business process re-engineering initiative, targeted to raise the share of loans linked to the marginal cost of funds-based lending rate (MCLR), helped the bank improve its margin. Most banks, meanwhile, reported a lower cost of deposits in the past quarter.

The ongoing re-pricing of deposits would, however, be offset by the re-pricing of MCLR-linked loans, which comes at a lag, bank executives said.

Higher MCLR-linked Loans

Private sector DCB Bank, Federal Bank, IDBI Bank, RBL Bank, and state-owned Punjab & Sind Bank are among the universal lenders that posted improved NIMs, a measure of profitability for banks from their lending activities. Among small finance banks, AU and Ujjivan reported higher margin prints in the second quarter.

Federal Bank’s NIM improved by 12 basis points to 3.06%, the fastest rise in the private sector category.

ICICI Bank executive director Sandeep Batra expects his bank’s NIM to remain range-bound with some benefits accruing from the cash reserve ratio (CRR) cuts, with re-pricing of deposits reducing costs. ICICI’s NIM for the second quarter came in at 4.30% against 4.34% in the preceding three-month period.

The CRR is being cut by 100 basis points, or a percentage point, in four equal instalments on September 6, October 4, November 1, and November 29. As a result, the impact of the final three phases will be realised in the ongoing third quarter.

The Chennai-based IOB, with a gross loan portfolio of ₹2.78 lakh crore, has brought down the share of loans linked to the RBI’s repo rate to about 46% at the end of September from about 55% in March, managing director Ajay Kumar Srivastava told ET. This strategic shift taken earlier in the year helped the bank improve its NIM, he said.

The share of the bank’s MCLR-linked loans, which react more slowly to policy rate changes, rose to 49% from about 45% over the last six months, he said.

IOB started implementing this plan at the beginning of the year. “This business re-engineering has yielded results,” Srivastava said.

ET on February 7 reported that some banks were trying to increase the share of MCLR-linked loans, anticipating repo rate cuts. Transmission of policy rate cuts happens automatically to loans linked to external benchmarks like repo. MCLR-linked loans are reset typically twice a year, thereby resulting in a slower transmission.

IOB’s NIM for the quarter was 3.21%, compared with 3.04% for the preceding quarter and 3.08% a year earlier.

You may also like

Trump aide says 'if anyone can make Gaza a beautiful destination spot, it's Trump'

Martin Odegaard injury return date statement as Arsenal captain shares alarming update

Donald Trump gives 'very exciting' update on UK nuclear submarine deal

Horror as girl found dead at home in quiet UK village as police investigate 'murder'

Liverpool players hold emergency meeting as Reds seek to avoid 72-year low