Even as Donald Trump’s new wave of tariffs redraws the world’s trade map and clouds the global outlook, India remains one of the few bright spots in an otherwise slowing global economy. The IMF’s October 2025 World Economic Outlook (WEO) projects India’s growth at 6.6% in 2025, up from 6.5% in 2024, before moderating slightly to 6.2% in 2026, signalling continued domestic momentum despite rising trade barriers.

By contrast, global output is expected to ease from 3.3% in 2024 to 3.2% in 2025 and 3.1% in 2026, as higher US tariffs slow trade and investment. This is well below the pre-pandemic average of 3.7%, reflecting a shift to a more fragmented and protectionist global landscape.

The IMF said the world economy “is adapting to a new policy landscape shaped by trade frictions, fiscal loosening, and divergent monetary paths.”

Advanced economies are forecast to grow just 1.6% in 2025 and 2026, while emerging markets are expected to expand 4.2% and 4.0% over the same period. Within Asia, India remains the key growth driver, even as China’s expansion slows to 4.8% in 2025 and 4.2% in 2026.

The world’s three largest economies -- the US, the Euro Area, and China -- are all showing signs of fatigue, with major manufacturing and export sectors softening and inflation proving stickier than expected.

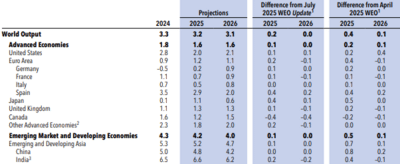

(Overview of the World Economic Outlook Projections)

The IMF attributes India’s resilience to strong private consumption, robust services growth, and policy stability, even as the United States slows under its own protectionist measures.

“Higher tariffs imposed by the United States are curtailing external demand, with profound implications for several large export-oriented economies, while heightened trade policy uncertainty is dampening firms’ appetite for investment,” the IMF said.

For India, the effect has been more muted so far. The IMF noted that the country’s 2025 projection is an upward revision from its July update, with carryover from a strong first quarter “more than offsetting the increase in the US effective tariff rate on imports from India since July.”

Protectionism starting to bite: IMF

The Fund’s October report marks the first full assessment of Trump’s sweeping trade actions, which pushed effective US tariff rates to their highest in nearly a century before partial rollbacks.

In a direct warning, the IMF observed, “There are increasing signs that the adverse effects of protectionist measures are starting to show. Patterns in net exports and inventories driven by front-loading behavior have largely reversed. Core inflation has risen in the United States, and unemployment has edged up. Inflation expectations are still fragile, worsening the trade-offs for monetary policymakers as uncertainty and tariffs start weighing on activity.”

The report cautioned that short-term resilience is giving way to longer-term strain, as the “tactics that keep activity seemingly resilient — such as trade diversion and rerouting — are costly,” leading to “suboptimal reallocation of productive resources” and “technological decoupling.”

The IMF made clear that while the tariff shock of April 2025 initially appeared smaller than feared, the delayed impact is now materialising. “Front-loading of consumption and investment gave a temporary boost to global activity in early 2025,” it said, “but the drag from shifting policies is becoming visible in more recent data.”

India’s cushion: Domestic demand and policy discipline

Amid this shifting terrain, India’s domestic economy continues to provide insulation.

The report noted that inflation in India came in below earlier forecasts, aided by stable food and energy prices, allowing the Reserve Bank of India to maintain a steady monetary stance.

Unlike several advanced economies still running pandemic-era fiscal deficits, India’s public finances remain relatively contained. The IMF flagged India as one of the few large economies where primary deficits are narrower than pre-pandemic averages and debt ratios broadly stable.

Resilient domestic demand, a solid services sector, and record agricultural output have kept India’s growth story intact, even as global trade slows.

The Fund credited India’s “improved policy fundamentals and private sector adaptability” for cushioning against external volatility.

Still, the report warned that “external conditions are becoming more challenging,” with “higher tariffs imposed by the United States curtailing external demand” and “heightened trade policy uncertainty dampening firms’ investment appetite.”

Global trade flows under pressure

The world’s trade volume in goods and services is projected to grow 3.6% in 2025, slowing to 2.3% in 2026- reflecting a front-loaded pattern as companies rushed shipments ahead of tariff deadlines.

In particular, the IMF noted that “global trade activity was robust in the first quarter of 2025, driven by strong growth in US imports and in exports from Asia and the Euro area because of front-loading in anticipation of higher tariffs.”

But that short-term surge is fading. “Patterns in inventories and net exports have largely reversed,” the IMF said, pointing to signs of weakening in major trading hubs.

For India, which remains less dependent on merchandise exports than many peers, the slowdown in global trade may not derail overall growth — though certain sectors such as textiles, steel, and electronics could face price pressures if tariffs persist.

Inflation, investment and currency effects

So far, tariffs have had a limited impact on global prices, but the IMF expects the pass-through to widen as firms exhaust profit buffers.

In the US, core goods inflation has begun to rise, while “exporters in Asia and Europe may not be able to maintain lower prices for much longer, given margin pressures.”

In a key difference from earlier trade conflicts, the US dollar has depreciated, not strengthened, as investors sought to hedge against uncertainty — a move that, according to the IMF, “amplified the tariff shock but also supported global trade and provided policymakers in emerging markets with room to support their economies.”

The Fund cautioned, however, that as margins compress and uncertainty persists, “the adverse effects of protectionist measures are starting to show.”

A fragmented world economy

The October report frames 2025 as a turning point- from short-term resilience to a slower, more fragmented global expansion.

Growth in advanced economies is projected to drop to 1.6%, weighed down by tighter financing and trade disruptions. The US will slow to 2.0% in 2025, Europe to 1.2%, while China cools to 4.8%.

The IMF warned that protectionism’s ripple effects could persist, as “technological decoupling and limitations on knowledge diffusion are bound to restrain growth over the longer term.”

It also flagged the risk that trade-policy uncertainty could shave up to 2% off global investment within two years, echoing estimates from its earlier analyses.

Challenges for India

For India, the challenge will be balancing domestic buoyancy with external fragility.

Even as higher US tariffs alter global supply chains, India stands to gain from some trade diversion — particularly in electronics, chemicals, and auto components — but may also face secondary effects through weaker global demand.

Still, the Fund expects India’s strong domestic drivers to keep growth steady. “The economy continues to display resilience,” it said, adding that the carryover from a strong first quarter has more than offset tariff-related headwinds.

The IMF’s October 2025 outlook captures a world economy still adjusting to Trump-era tariffs- smaller in size than initially feared, but more corrosive in effect.

The headline message: global growth will cool, trade will thin, and uncertainty will linger.

India, for now, remains the outlier- growing faster than any major economy, shielded by its consumption-driven model and steady macro fundamentals. But as the IMF warns, the longer protectionism persists, the harder it will be for even the most resilient economies to stay immune.

By contrast, global output is expected to ease from 3.3% in 2024 to 3.2% in 2025 and 3.1% in 2026, as higher US tariffs slow trade and investment. This is well below the pre-pandemic average of 3.7%, reflecting a shift to a more fragmented and protectionist global landscape.

The IMF said the world economy “is adapting to a new policy landscape shaped by trade frictions, fiscal loosening, and divergent monetary paths.”

Advanced economies are forecast to grow just 1.6% in 2025 and 2026, while emerging markets are expected to expand 4.2% and 4.0% over the same period. Within Asia, India remains the key growth driver, even as China’s expansion slows to 4.8% in 2025 and 4.2% in 2026.

The world’s three largest economies -- the US, the Euro Area, and China -- are all showing signs of fatigue, with major manufacturing and export sectors softening and inflation proving stickier than expected.

(Overview of the World Economic Outlook Projections)

The IMF attributes India’s resilience to strong private consumption, robust services growth, and policy stability, even as the United States slows under its own protectionist measures.

“Higher tariffs imposed by the United States are curtailing external demand, with profound implications for several large export-oriented economies, while heightened trade policy uncertainty is dampening firms’ appetite for investment,” the IMF said.

For India, the effect has been more muted so far. The IMF noted that the country’s 2025 projection is an upward revision from its July update, with carryover from a strong first quarter “more than offsetting the increase in the US effective tariff rate on imports from India since July.”

Protectionism starting to bite: IMF

The Fund’s October report marks the first full assessment of Trump’s sweeping trade actions, which pushed effective US tariff rates to their highest in nearly a century before partial rollbacks.

In a direct warning, the IMF observed, “There are increasing signs that the adverse effects of protectionist measures are starting to show. Patterns in net exports and inventories driven by front-loading behavior have largely reversed. Core inflation has risen in the United States, and unemployment has edged up. Inflation expectations are still fragile, worsening the trade-offs for monetary policymakers as uncertainty and tariffs start weighing on activity.”

The report cautioned that short-term resilience is giving way to longer-term strain, as the “tactics that keep activity seemingly resilient — such as trade diversion and rerouting — are costly,” leading to “suboptimal reallocation of productive resources” and “technological decoupling.”

The IMF made clear that while the tariff shock of April 2025 initially appeared smaller than feared, the delayed impact is now materialising. “Front-loading of consumption and investment gave a temporary boost to global activity in early 2025,” it said, “but the drag from shifting policies is becoming visible in more recent data.”

India’s cushion: Domestic demand and policy discipline

Amid this shifting terrain, India’s domestic economy continues to provide insulation.

The report noted that inflation in India came in below earlier forecasts, aided by stable food and energy prices, allowing the Reserve Bank of India to maintain a steady monetary stance.

Unlike several advanced economies still running pandemic-era fiscal deficits, India’s public finances remain relatively contained. The IMF flagged India as one of the few large economies where primary deficits are narrower than pre-pandemic averages and debt ratios broadly stable.

Resilient domestic demand, a solid services sector, and record agricultural output have kept India’s growth story intact, even as global trade slows.

The Fund credited India’s “improved policy fundamentals and private sector adaptability” for cushioning against external volatility.

Still, the report warned that “external conditions are becoming more challenging,” with “higher tariffs imposed by the United States curtailing external demand” and “heightened trade policy uncertainty dampening firms’ investment appetite.”

Global trade flows under pressure

The world’s trade volume in goods and services is projected to grow 3.6% in 2025, slowing to 2.3% in 2026- reflecting a front-loaded pattern as companies rushed shipments ahead of tariff deadlines.

In particular, the IMF noted that “global trade activity was robust in the first quarter of 2025, driven by strong growth in US imports and in exports from Asia and the Euro area because of front-loading in anticipation of higher tariffs.”

But that short-term surge is fading. “Patterns in inventories and net exports have largely reversed,” the IMF said, pointing to signs of weakening in major trading hubs.

For India, which remains less dependent on merchandise exports than many peers, the slowdown in global trade may not derail overall growth — though certain sectors such as textiles, steel, and electronics could face price pressures if tariffs persist.

Inflation, investment and currency effects

So far, tariffs have had a limited impact on global prices, but the IMF expects the pass-through to widen as firms exhaust profit buffers.

In the US, core goods inflation has begun to rise, while “exporters in Asia and Europe may not be able to maintain lower prices for much longer, given margin pressures.”

In a key difference from earlier trade conflicts, the US dollar has depreciated, not strengthened, as investors sought to hedge against uncertainty — a move that, according to the IMF, “amplified the tariff shock but also supported global trade and provided policymakers in emerging markets with room to support their economies.”

The Fund cautioned, however, that as margins compress and uncertainty persists, “the adverse effects of protectionist measures are starting to show.”

A fragmented world economy

The October report frames 2025 as a turning point- from short-term resilience to a slower, more fragmented global expansion.

Growth in advanced economies is projected to drop to 1.6%, weighed down by tighter financing and trade disruptions. The US will slow to 2.0% in 2025, Europe to 1.2%, while China cools to 4.8%.

The IMF warned that protectionism’s ripple effects could persist, as “technological decoupling and limitations on knowledge diffusion are bound to restrain growth over the longer term.”

It also flagged the risk that trade-policy uncertainty could shave up to 2% off global investment within two years, echoing estimates from its earlier analyses.

Challenges for India

For India, the challenge will be balancing domestic buoyancy with external fragility.

Even as higher US tariffs alter global supply chains, India stands to gain from some trade diversion — particularly in electronics, chemicals, and auto components — but may also face secondary effects through weaker global demand.

Still, the Fund expects India’s strong domestic drivers to keep growth steady. “The economy continues to display resilience,” it said, adding that the carryover from a strong first quarter has more than offset tariff-related headwinds.

The IMF’s October 2025 outlook captures a world economy still adjusting to Trump-era tariffs- smaller in size than initially feared, but more corrosive in effect.

The headline message: global growth will cool, trade will thin, and uncertainty will linger.

India, for now, remains the outlier- growing faster than any major economy, shielded by its consumption-driven model and steady macro fundamentals. But as the IMF warns, the longer protectionism persists, the harder it will be for even the most resilient economies to stay immune.

You may also like

Gardeners urged to stop mowing lawns before November

Margaret Thatcher 'had two affairs' explosive new book claims

Pak-Afghan clashes: Heavy fighting in Khyber Pakhtunkhwa leaves senior commander dead; Taliban posts damaged

IndiaAI Mission Invites Startups To Build AI Facial Recognition Tool

GB News halted for breaking news as Trump awards late Charlie Kirk highest honour