For Bhavish Aggarwal and Ola Electric, the narrative is one of perpetual motion; a company that claims it is shifting from a hypergrowth EV disruptor to a maturing company focused on the long game.

The leadership speaks of consolidation, of profits finally being extracted from its much-vaunted full-stack approach, and of a future defined by capital efficiency and vertical integration.

This bullishness found a receptive audience, at least for a day, as the company’s stock surged nearly 18% following its Q1 FY26 results, buoyed by guidance that its auto business had, for the first time, turned EBITDA positive in the month of June.

But when one peels back the layers of this corporate messaging, and a far more challenging picture emerges, one where the uphill climb for the Indian EV maker seems to get steeper with every passing quarter. The past several months have been a crucible for Ola Electric, testing its foundations and questioning the very disruption narrative it champions.

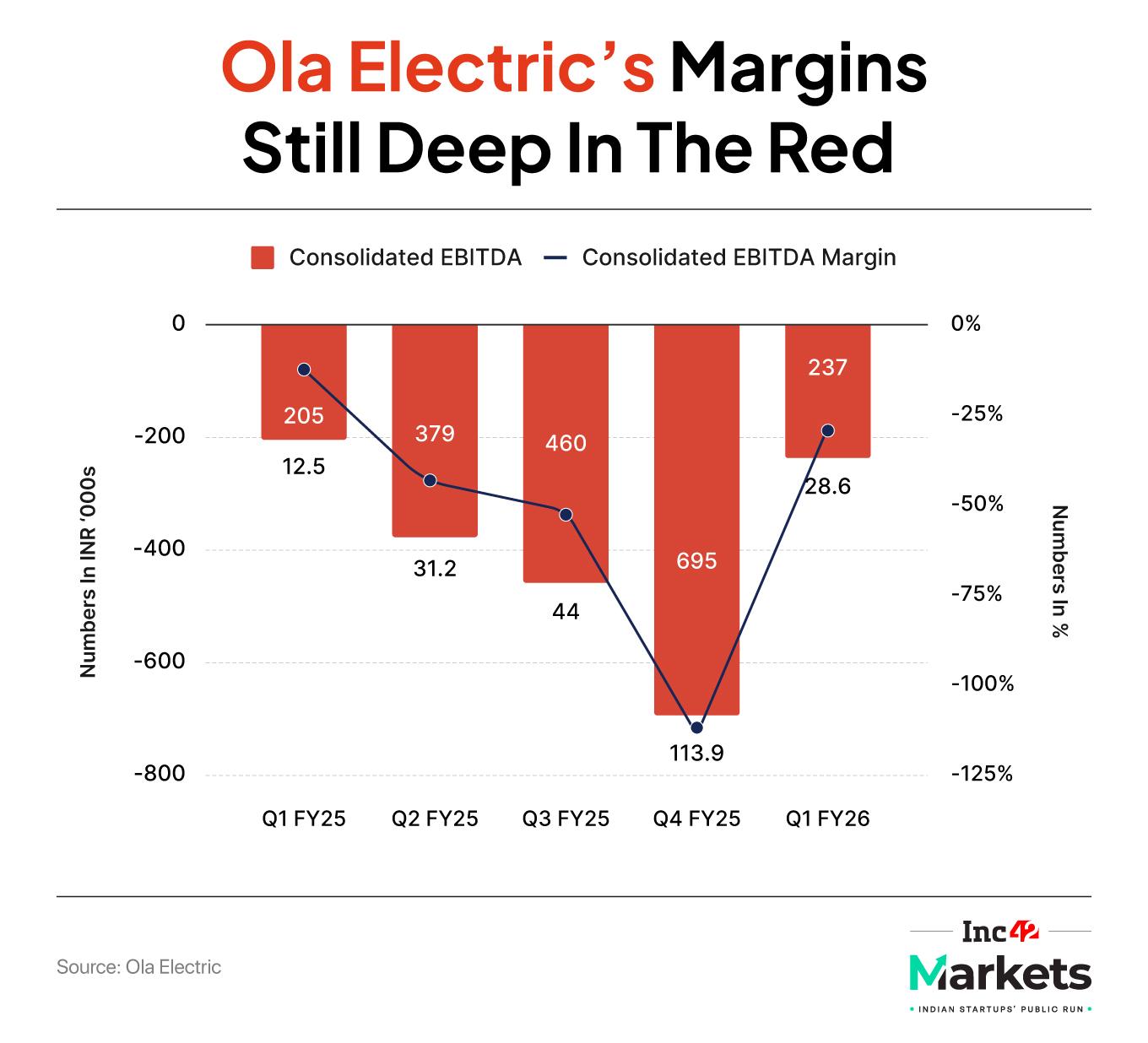

While the company celebrates a single month of positive EBITDA in its auto segment, the larger financial portrait is starkly negative.

The consolidated net loss in the first quarter of FY26 widened by 23% year-on-year (YoY) to INR 428 Cr. This was accompanied by a brutal 50% collapse in revenue from operations, down to INR 828 Cr from INR 1,644 Cr in the same quarter last year.

This wasn’t a one-off bad quarter; it was the continuation of a worrying trend. The preceding quarter, Q4 FY25, was what Aggarwal himself described as “complex”. To put it mildly, it was a bad hit to the reputation of the company which claims to be a pioneer in the EV space.

The company’s consolidated net loss more than doubled to a staggering INR 870 Cr, a 109% surge from the INR 416 Cr loss a year prior. Revenue from operations didn’t just slip; it plummeted by a whopping 62% YoY to INR 611 Cr from INR 1,598 Cr. The stock market, that unforgiving barometer of sentiment, reacted predictably. Following the Q4 results, Ola Electric’s shares tanked by 10%,

The pain for investors has only gotten worse since listing and prolonged. The stock has been on a relentless downward trajectory, hitting a fresh all-time low of INR 43.15 in June, a gut-wrenching 68% decline from its 52-week high.

This wasn’t just retail investor panic; the institutional players have been voting with their feet. Mutual funds, despite increasing their broader market investments, systematically lowered their stake in Ola Electric, trimming it from 4.1% in Q3 to just 2.6% in Q4. The sell-off crescendoed with the stunning exit of a major automotive backer. In a series of block deals, Hyundai completely offloaded its 2.47% stake, while affiliate Kia also dumped its shares, with the combined exit valued at over INR 689 Cr.

Pressure Builds Up For Ola ElectricThis sustained erosion of value created pressure right at the top. As the stock price continued to skid, founder Bhavish Aggarwal was reportedly forced to pay around INR 20 Cr in cash to top up collateral for personal borrowings he had taken against his Ola Electric shares to fund his other venture, Krutrim AI. While sources claimed no margin calls were triggered, the necessity of such a move speaks volumes about the financial strain caused by the stock’s freefall.

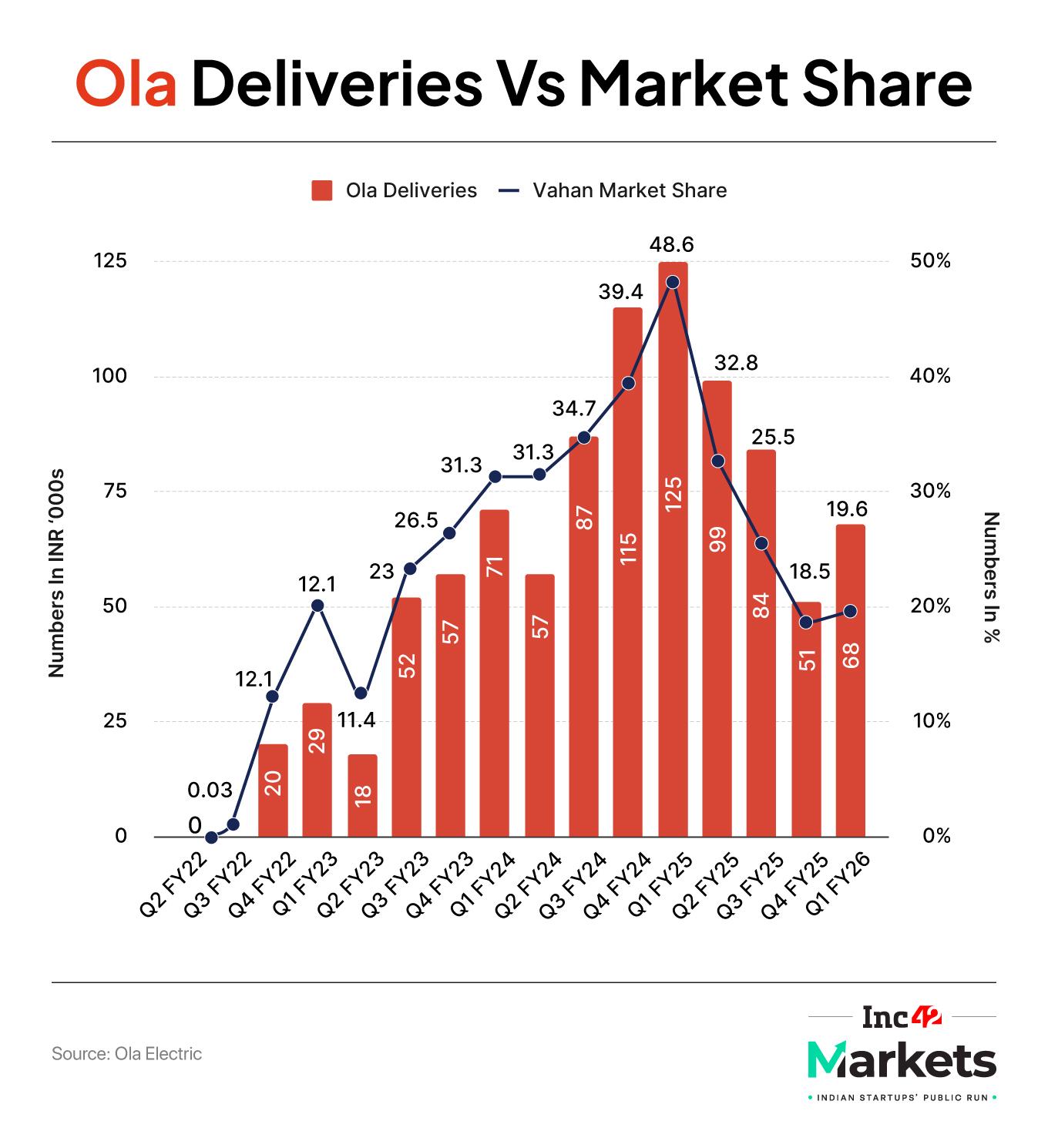

Beyond the bleak financials, deeper, more fundamental challenges persist. Once the undisputed king of the EV two-wheeler market, Ola Electric’s dominance has crumbled. Its market share, which once peaked at a formidable 48.6%, had fallen to 19.6% by Q1 FY26.

The legacy players that Ola sought to disrupt are now fighting back with formidable force. Saharsh Damani, CEO of the Federation Of Automobile Dealers Associations (FADA), pointed out earlier that Ola Electric’s initial success came in a market largely devoid of giants like TVS Motor, Bajaj Auto, and Hero MotoCorp.

Now, these players are ramping up, and their manufacturing prowess and established trust are chipping away at Ola’s lead. In a telling sign of this shift, rival Ather Energy, once a distant competitor, actually posted higher operating revenue than Ola Electric in Q4 FY25. Some analysts now give more weight to Ather, citing its “superior product quality and better management”.

The company’s reputation has been battered by a year of controversies. And this is evident from the drop in sales.

Vehicle deliveries in Q1 FY26 stood at 68,192 units, a steep drop from the 1,25,198 units delivered in the same quarter last year. This at a time when the market as a whole grew significantly. Compared to Ola Electric’s 45% decline, the market grew by 33%.

As Damani said, “Disruption alone doesn’t guarantee sustainability. Culture, governance, and stakeholder trust matter more than hype.”

Faced with this onslaught, Ola is attempting to pivot its narrative. The mantra is no longer just about hypergrowth but about sustainability and vertical integration. Aggarwal now speaks of investments being weighted towards research and development over manufacturing capex.

The company touts its in-house development of critical components, from motors to the 4680 Bharat Cell, arguing this insulates it from supply chain volatility and improves gross margins. Even the ambitious Gigafactory plan has been prudently scaled back, from a planned 6.4 GWh capacity to 5 GWh, a move the company says is sufficient to meet needs through FY29.

However, the promises continue to be aggressive, and to many, vague. The company, which in February 2025 projected it needed to sell 50,000 scooters a month to hit EBITDA breakeven, suddenly halved that number to 25,000 in a later investor meeting, citing cost reductions.

This has left many shareholders puzzled. Even as the company projects a gross margin of 35%-40% and full-year auto EBITDA of above 5% for FY26, the calculations behind these figures remain largely opaque.

The ambition to manufacture cells in-house is also fraught with risk. Automotive veterans express deep concern, noting that cell making is an intensely complex process that takes years to perfect. Battery technology launched in a hurry to meet projections could create a massive safety issue, a far bigger problem than missed sales targets.

Ola Electric is a company at a crossroads, caught between its own bullish pronouncements and a market that is demanding results, not just rhetoric. The challenges are no longer just about scaling up; they are about rebuilding trust, proving financial viability, and fending off powerful, deep-pocketed competitors. The window to capitalize on its initial disruption is narrowing.

While Aggarwal and Co is trying to show improvements in the fundamentals, the persistent losses, fleeing investors, and operational hurdles paint a picture of a company still searching for the missing pieces of its grand vision.

The question as ever is whether Bhavish Aggarwal can course-correct and assemble these pieces in time, or if the initial hype around Ola Electric will be drowned out by the sobering reality of the balance sheet.

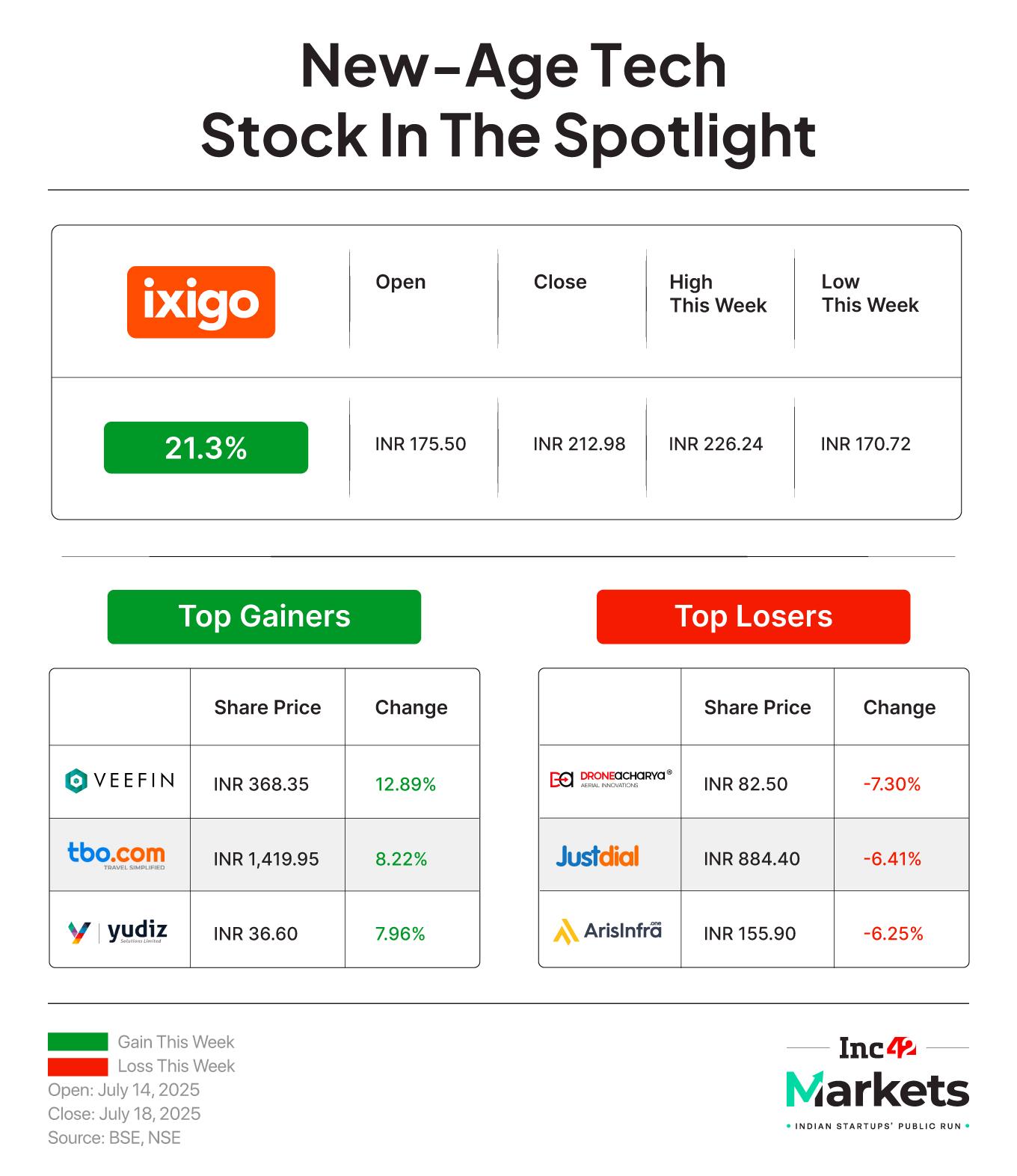

Markets Watch: New IPOs, Q1 Results & More- ixigo’s Profit Run: The OTA reported a net profit of INR 18.9 Cr in Q1 FY26, up 27% from INR 14.9 Cr in the year-ago quarter. ixigo’s operating revenue surged 73% YoY to INR 314.5 Cr. Meanwhile, thetravel tech platform will acquire an additional 11% stake in Zoop.

- WeWork India IPO Gets Nod: After putting the coworking major’s DRHP in abeyance earlier this year, the market regulator has now greenlit the IPO. The Bengaluru-based coworking giant’s public issue will only comprise an OFS component of up to 4.4 Cr equity shares.

- Justdial’s Q1 Show: The hyperlocal search engine’s net profit grew 13% to INR 159.7 Cr in Q1 FY26 from INR 141.2 Cr in the year-ago quarter. The company’s operating revenue also rose 6% YoY to INR 297.9 Cr during the June quarter.

- JFS Profits Flat: The Reliance-backed financial services giant reported a profit of INR 324.7 Cr in Q1 FY26, up 4% from INR 312.6 Cr in the same quarter of the previous fiscal. Meanwhile, operating revenues jumped 48% YoY to INR 612.5 Cr.

- Smartworks’ Bumper Listing: The coworking major ended its maiden trading session on the BSE at INR 445.10, up 9.3% from the issue price of INR 407. The company opened on the stock exchange at a premium of 7.14% at INR 436.10 apiece on the BSE

- IndiQube All Set For IPO: As per the managed coworking space startup’s RHP, it has cut the size of its fresh issue to INR 650 Cr while the OFS component has been halved to INR 50 Cr. The startup’s IPO will now open on July 23 and close on July 25.

The post Ola Electric’s Profit Dream: A Bridge Too Far? appeared first on Inc42 Media.

You may also like

CBSE tightens school safety norms; makes CCTV cameras mandatory in classrooms, corridors, playgrounds: New safety rule explained

Bumper discount on Honda cars in July! Golden opportunity to take your favorite car home with discount

The Aussie actress who gives Nicole Kidman a run for her money and it's not Margot Robbie

Molly-Mae Hague told to 'stop complaining' as she grumbles about holiday adventure

'You Wanted To Fall To Your Knees': Carse On England's Unbelievable Win At Lord's